Fixed-point survey on consumption trends (May 2024)

2024 / 05 / 21

The Fixed-point Survey on Consumption Trends (May 2024) was conducted on 1,200 men and women aged 20-69 residing in 47 prefectures in Japan. The Fixed-point Survey on Consumption Trends is conducted twice a year (May and October) to compare the current living conditions of consumers with those of the past in terms of income, consumption, and behavior, and to obtain basic data for judging economic trends. In this survey, we examined the actual living conditions, consumption trends, business confidence and consumption forecasts, and cashless payment and self-checkout usage on May 1-2, 2024, when prices continued to rise, the yen depreciated rapidly, and the number of foreign visitors to Japan exceeded 3 million for two consecutive months.

The report is available for download in the Japanese version of the article.

*The report is only available in the Japanese version.

- Payroll income and savings rose from a year ago, but consumption behavior declined.

Business confidence remains weak over the next year.

Click here for related research. ※Switch to Japanese

Survey Result Topics

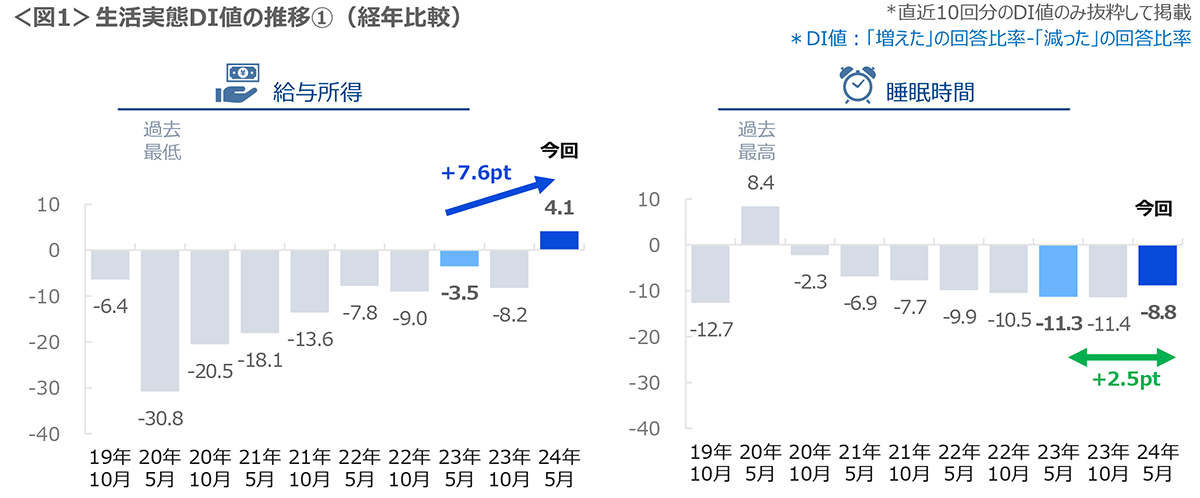

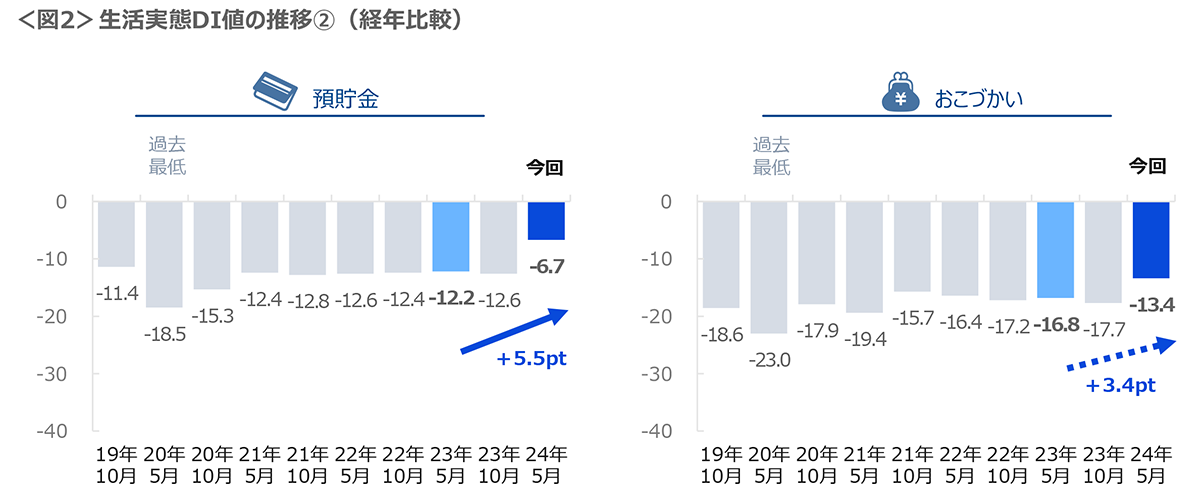

In the 2024 Spring Struggle, there was a series of high level wage increase responses mainly from major companies, and the DI for "salary income" increased by 8 pt from the same period of the previous year. Deposits and savings also rose by 6 points. Spending money" rose slightly from the same period of the previous year. <Figures 1 and 2>

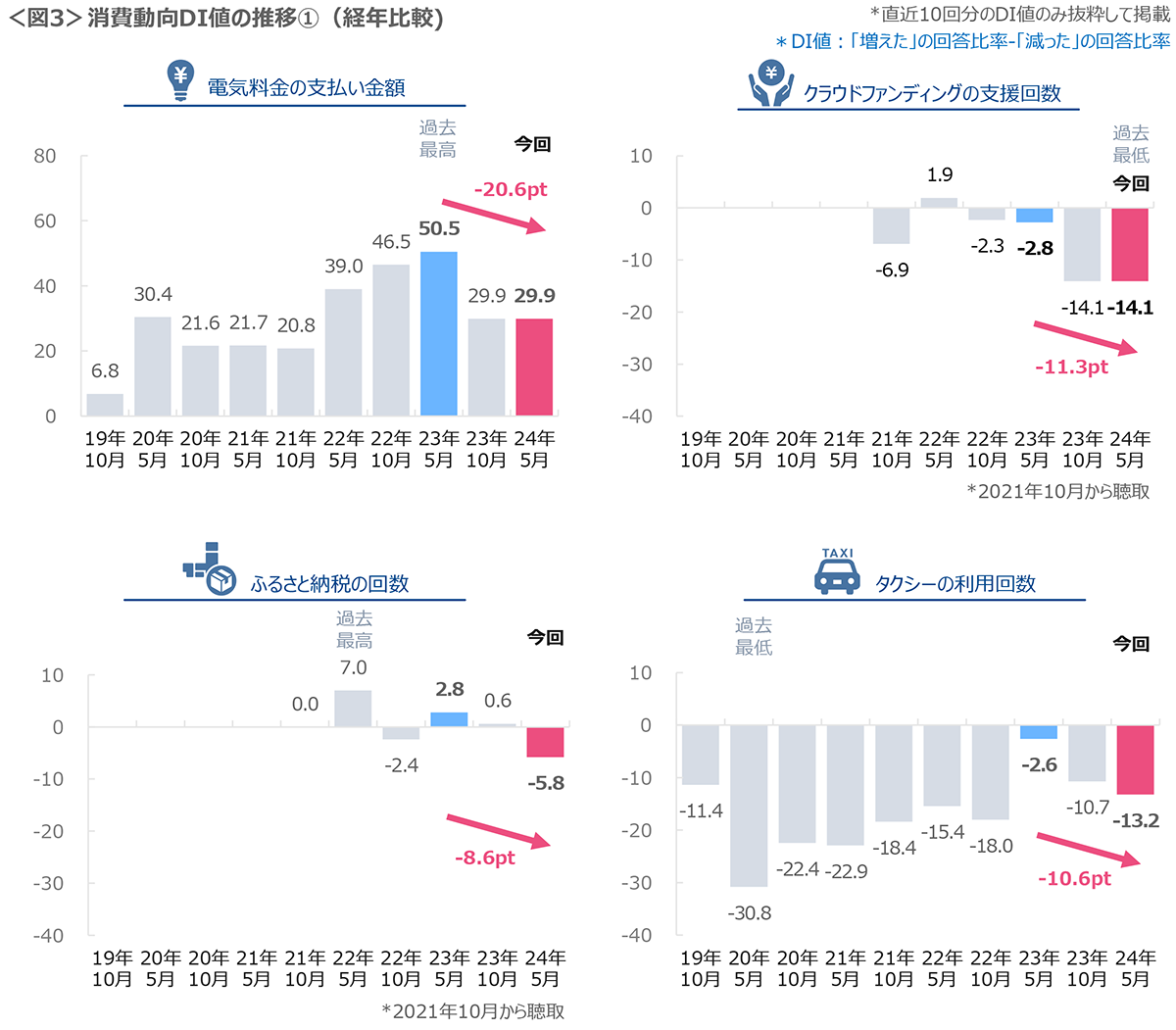

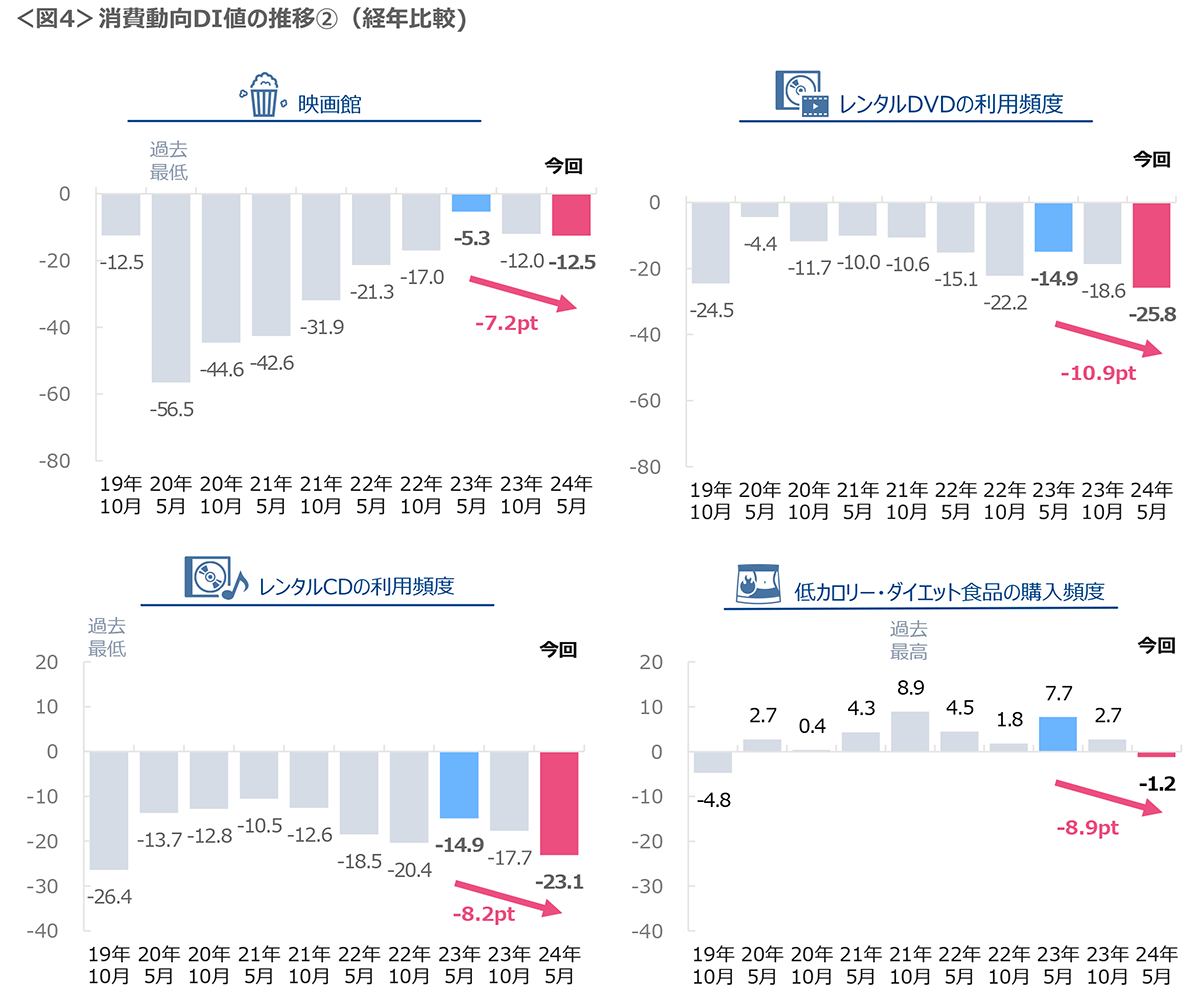

Regarding consumption trends, "Amount paid for electricity" declined sharply by 21 pt YoY, partly due to the subsidy system under the Electricity and Gas Price Reduction Project. The number of times respondents supported crowdfunding" and "the number of times they paid taxes in their hometowns" were at record lows. Frequency of using "cab," "movie theater," "rental DVD," "rental CD" and "purchase of low-calorie/diet food" decreased by 7-11 points from the same period last year. Most of the other items surveyed in this study also showed negative trends compared to the same period last year, with none showing an increase. <Figures 3 and 4>

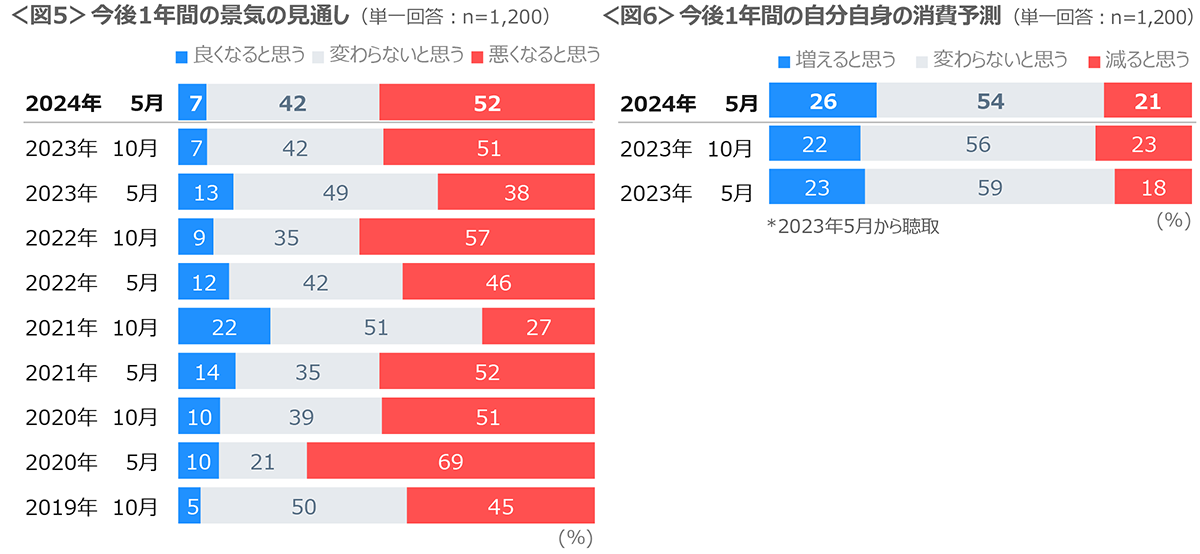

In June 2024, a survey on SDGs was conducted with 2,500 men and women aged 18 to 69 across the nation. AccordiWith 52% of respondents saying they "think the economy will get worse" over the next year, half of the respondents said they "think it will get better," while only about 7% said they "think it will get better," indicating that business confidence is as poor as in October 2023. <Figure 5>

54% of respondents said they expect their own consumption to "stay the same" over the next year, while 26% said they "think it will increase," indicating an increase. <Figure 6>

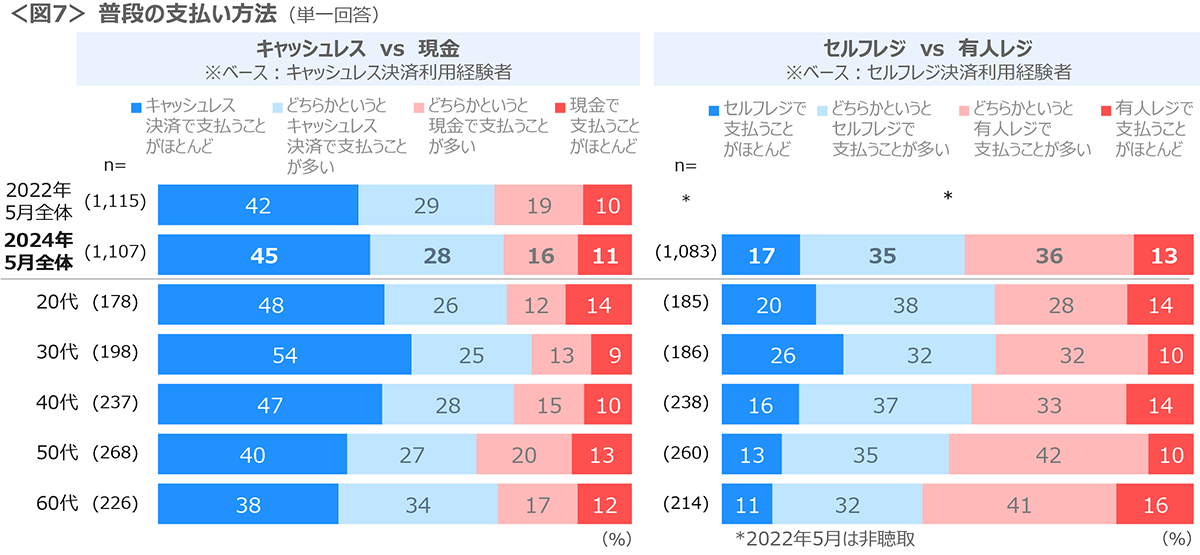

The percentage of respondents in their 30s is 54%, more than half of the respondents in their 30s. The proportion of respondents in their 20s and 30s, who mostly pay at self-checkout counters, is 17%, more than 20%, while those in their 40s and beyond will increasingly pay at manned cash registers as their age increases. <Figure 7>

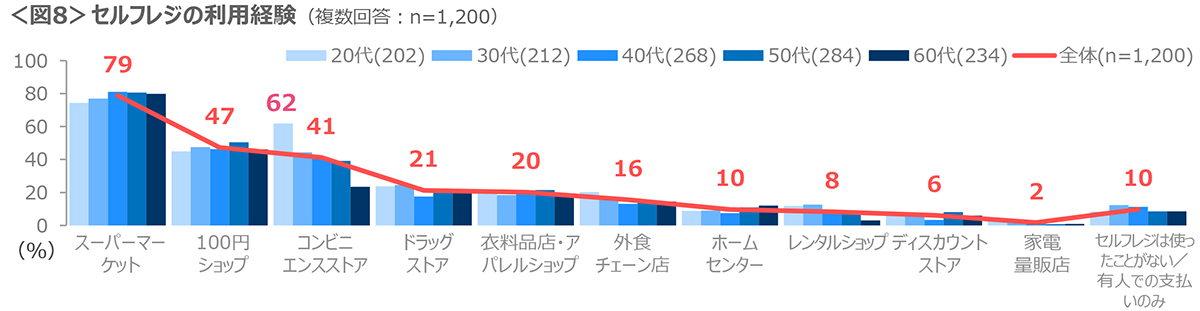

Supermarkets (79%), followed by 100-yen stores (47%), and convenience stores (41%), with convenience stores (62%) being the most popular self-checkout locations, especially among those in their 20s. <Figure 8>

□ Survey Summary

□ Comparison of Living Conditions with the Same Period Last Year

□ Trends in Living Conditions

□ Comparison of Consumption Trends with the Same Period Last Year

□ Trends in Consumption Trends

□ Future Economic Outlook

□ Subscription Service Usage

□ Online Shopping Usage in the Last 3 Months

□ Online Shopping Subscription Purchase Status

□ Cashless Payment Usage Status / Future intention

□ Self checkout usage / Future intention

Survey Overview

| Survey Method | Internet Research |

| Survey Region | 47 prefectures in Japan |

| Survey Target | Men and women aged 20-69 |

| Survey Period | Wednesday, May 1 - Thursday, May 2, 2024 |

| Valid Responses | 1,200 sample (allocated based on population composition) |

Note: Due to rounding, the composition ratio may not add up to 100% in the survey results.

The report is available for download in the Japanese version of the article.

*The report is only available in the Japanese version.

Credit Attribution for Citation and Reproduction

When citing or reproducing this release, please be sure to clearly credit our company as follows:

Example: "According to a survey conducted by Cross Marketing, a marketing research company..."

Contact Information for Media Inquiries

Public Relations: Marketing Department

Phone: 03-6859-1192

Email: pr-cm@cross-m.co.jp