Survey on Games (2024) Consumer Games

2024 / 07 / 11

From June to July 2024, we conducted the "Survey on Games (2024) Consumer Games" targeting 1,168 men and women aged 15-69 nationwide who play consumer games at least once a month. This year's analysis focused on frequency of playing, playing time and amount spent compared to one year ago, game genres played, game-related expenses paid, and media for purchasing games.

The report is available for download in the Japanese version of the article.

*The report is only available in the Japanese version.

- 40% of 15-19 year olds play action and sandbox games.

The number of purchasers of digital versions of games is increasing, a sign of a shift to digital versions.

Click here for related research. ※Switch to Japanese

Survey Result Topics

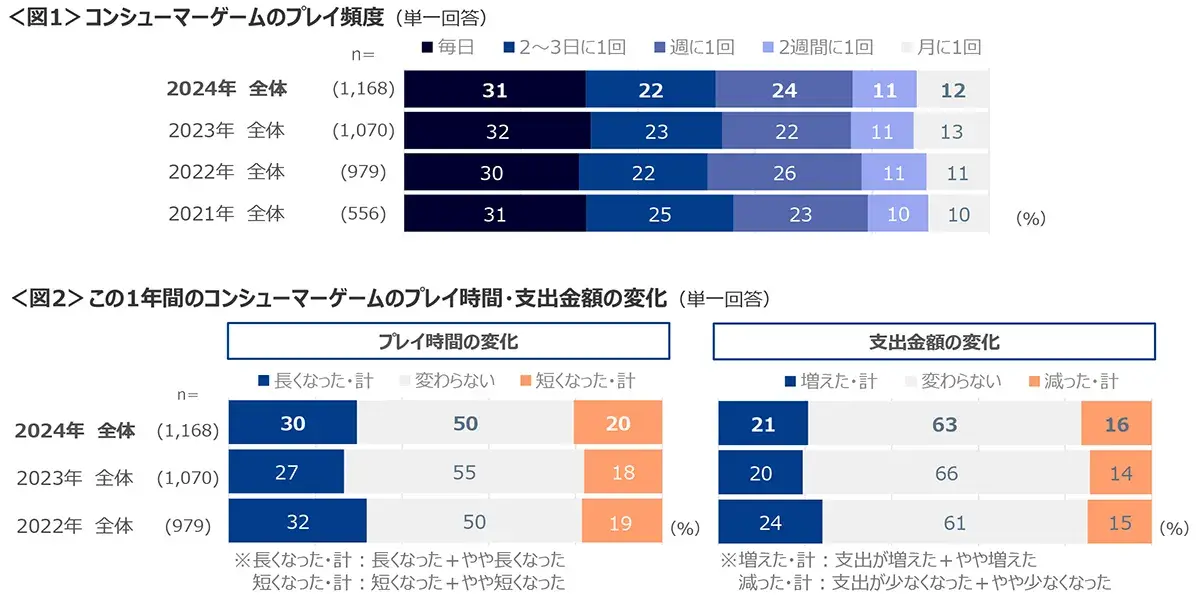

Of those who enjoy playing consumer games at least once a month, 31% play "every day," and together with the 22% who play "once every two to three days," 53% play frequently. The results for the past four years show no significant change in frequency of playing. <Figure 1>

Compared to a year ago, 50% say their playing time has "stayed the same" and 30% say it has "gotten longer." Although price increases in in-game fees and equipment have continued since the fall of 2022, spending has remained at the 60% level for the past three years, with 63% saying their spending has "stayed the same" as a year ago. It can be inferred that for those who enjoy playing consumer games, changes in behavior before and after the Corona disaster and price hikes have little impact on playing time and spending. <Figure 2>

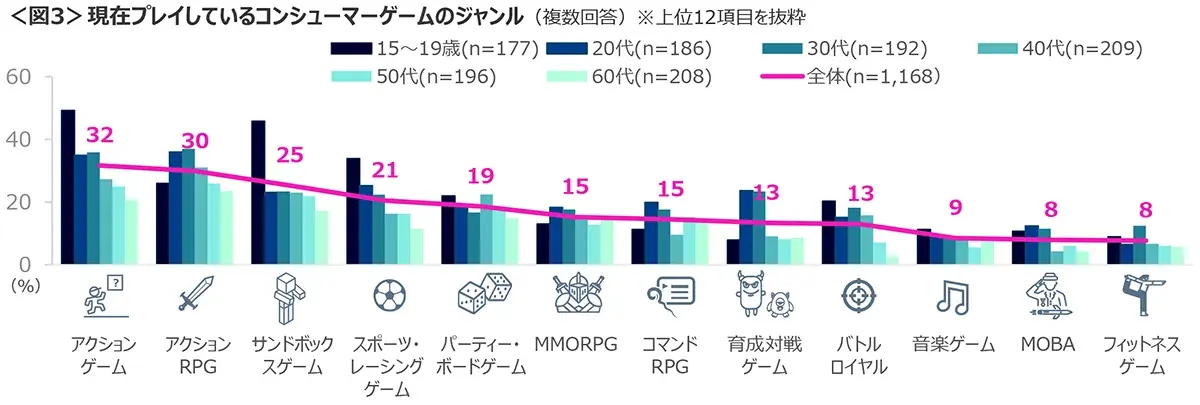

The respondents were asked about their current game titles, and the genres they play. Action games (Splatoon 3, etc.)" 32%, "Action RPGs (The Legend of Zelda: Tears of the Kingdom, etc.)" 30%, "Sandbox games (Atsumare Animal Crossing, etc.)" 25%, "Sports/racing games (Mario Kart 8 Deluxe, etc.)" 21%, " Party/board games (Momotaro Dentetsu World: Chikyu wa HOPE de Mawaru! 〜The 15-19 year olds were significantly more likely than other age groups to play "action," "sandbox," and "sports/racing" games, at 30%-40%. <Figure 3>

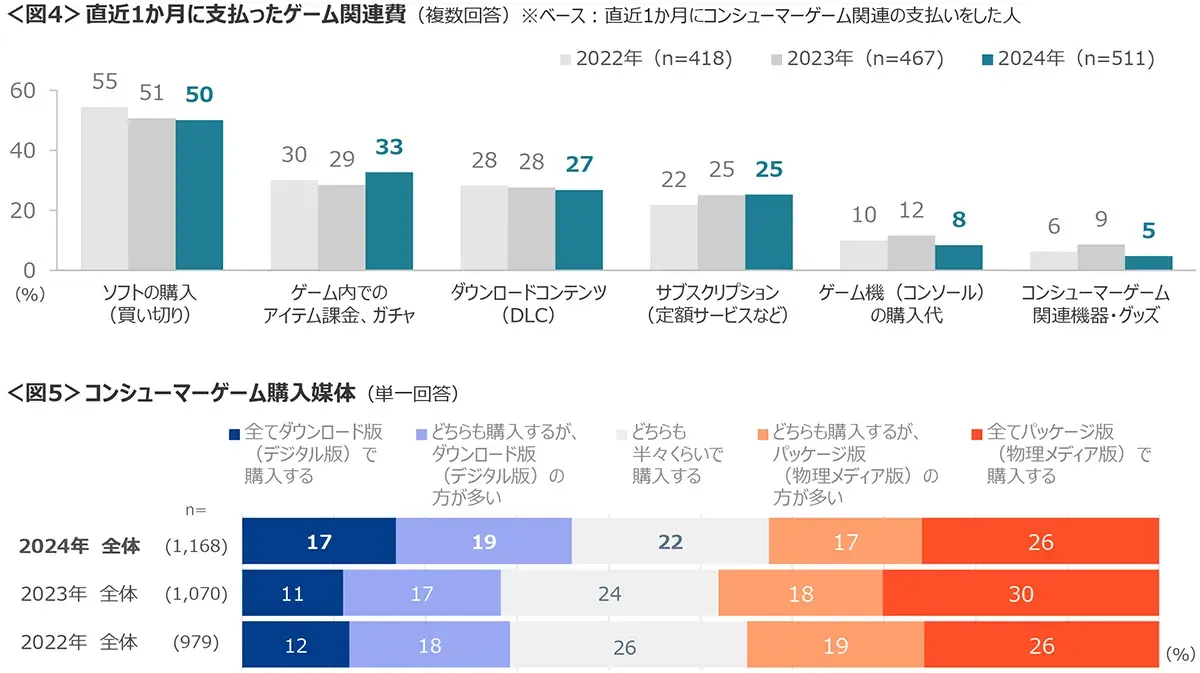

The main game-related expenses paid in the past month were "Software purchase (buy-out)" at 50%, "In-game item charges, gacha" at 33%, "Downloadable content (DLC)" at 27%, and "Subscription (fixed price service)" at 25%. In-game item charges and "Gacha" were the highest in the past three years. <Figure 4>

When purchasing games, the majority of respondents (26%) chose "All purchases are packaged (physical media version). The proportion of respondents who "Purchase all games by downloading (digital version)" increased by 6 pt from the previous year. <Figure 5> "All purchases are for package (physical media)" was up 6 pt from last year. <Figure 5>

□ Attribute questions (gender/age/location/marital status/children/occupation)

□ Summary of survey results

▼ Attributes of consumer game players

□ Frequency of playing consumer games

□ Game playing time on weekdays and holidays

□ Change in time and expenditure on games in the last one year

□ Information gathering media/ information about games Media for sharing/dissemination

▼ Actual status and attitude toward playing consumer games

□ Scenes of playing/playing partners

□ Current game titles/game genres

□ Current game playing devices

□ Amount spent in the last one month (software purchase/payment/subscription)/how to spend the money

□ Reasons for playing games

□ Focus in choosing games

□ Medium of purchase

□ Correspondence analysis of game genres/reasons for playing games

Survey Overview

| Survey Method | Internet Research |

| Survey Region | 47 prefectures in Japan |

| Survey Target | Men and women aged 15-69 who play consumer games at least once a month. |

| Survey Period | 2021: Friday, August 6 - Monday, August 9 2022: Friday, July 1 - Sunday, July 3 2023: Friday, July 7 - Monday, July 10 2024: Friday, June 28 - Tuesday, July 2 |

| Valid Responses | 2021: 556 samples in this survey 2022: 979 samples in this survey 2023: 1,070 samples in this survey 2024: 1,168 samples in this survey |

Note: Due to rounding, the composition ratio may not add up to 100% in the survey results.

The report is available for download in the Japanese version of the article.

*The report is only available in the Japanese version.

Credit Attribution for Citation and Reproduction

When citing or reproducing this release, please be sure to clearly credit our company as follows:

Example: "According to a survey conducted by Cross Marketing, a marketing research company..."

Contact Information for Media Inquiries

Public Relations: Marketing Department

Phone: 03-6859-1192

Email: pr-cm@cross-m.co.jp